"Wave Motion Gun" (slowinslowout)

"Wave Motion Gun" (slowinslowout)

02/23/2014 at 19:35 ē Filed to: banks, crooks, stolen money, criminals, wells fargo

7

7

59

59

"Wave Motion Gun" (slowinslowout)

"Wave Motion Gun" (slowinslowout)

02/23/2014 at 19:35 ē Filed to: banks, crooks, stolen money, criminals, wells fargo |  7 7

|  59 59 |

Here's a lesson for you all: Don't trust Wells Fargo Bank with any of your money, they will steal it and will have no problems telling you that it is their policy to do so.

On Friday, February 21, 2014, I brought a check into my local Wells Fargo branch in the amount of $86,586.88. I spoke with a branch manager regarding the deposit, and asked if $2500 of the deposit could be cashed immediately because I had several transactions that I needed to make, with the remainder being subject to whatever hold they require. I've been a customer of Wells Fargo for several years, have a mortgage through them, and have a relationship with the local bank, so this was not a problem. I was given $2500 in cash, which I immediately deposited into my account, and thanked them for their great customer service.

I left the bank, immediately checked my account, and saw that the cash deposit was credited and posted, meaning it was available for use as I saw fit. As a result, I paid a number of bills online which will be posting tomorrow, February 24, 2014. Today, I went to a local retailer and made a purchase, which I attempted to pay for with my Wells Fargo Debit Card which is attached to this account. It was declined. I thought this was odd, as I had at least $2500 cash in this account, so I checked my balance. The $2500 was not there.

I completed my purchase using another means of payment, and went home to review my account and make sure I hadn't been compromised by a fraudster. It turns out I had. Wells Fargo deducted the $2500 cash deposit I had made just one day prior without notification of any sort. I called Wells Fargo and they explained to me that the entire deposit I had made was now subject to a 7 business day hold, and that the decision that was made to give me $2500 of the original deposit was being changed after they literally handed me 25 100 dollar bills which I then gave back to them for a deposit. They had the audacity to tell me that, had I kept the $2500 in cash, they would have placed my account in an overdrawn status even though it was their decision to give me the money in the first place. They have also informed me that any funds that are attempted to be withdrawn before the hold is released will not be credited to those that I am paying, and any penalties that I incur are my sole responsibility.

Wells Fargo Bank did not offer any notification that they were not going to honor the obligation to which they committed themselves, and subsequently reneged upon, and are placing me in a position where I will be subject to the embarrassment and inconvenience of having payments made to those that I am obligated to pay declined, for which I will be held responsible with no recourse.

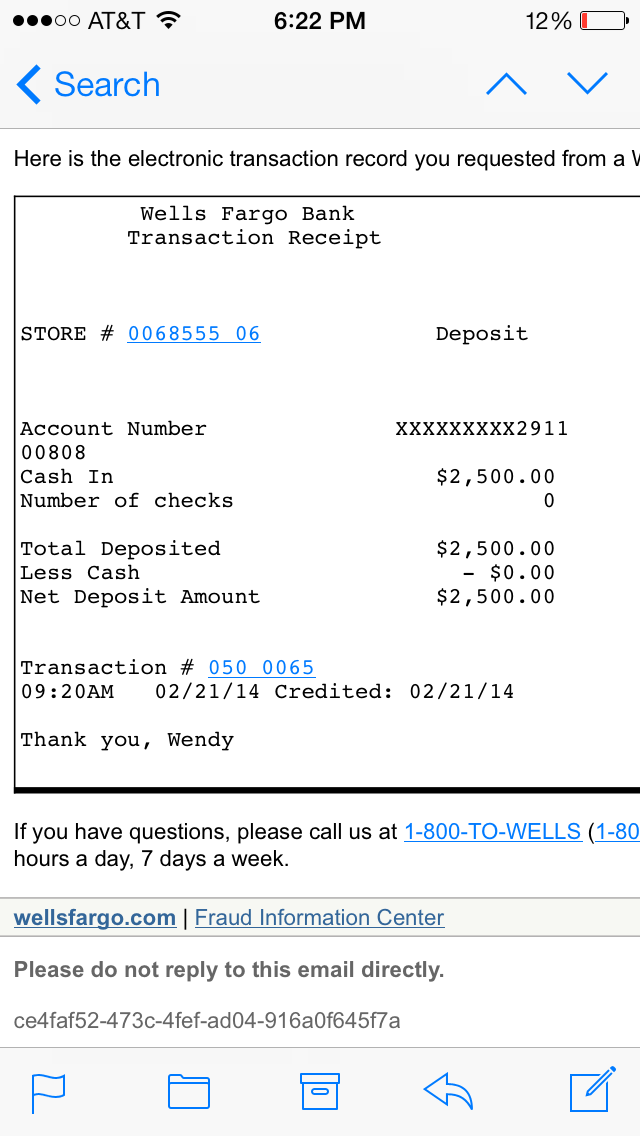

In the past 30 minutes, Wells Fargo has updated my online banking profile to completely eliminate any record of the $2500 deposit occurring. It was there an hour ago, plain as day. Now it is completely gone, as if it never happened. They are working hard to make this my problem, when it is completely on them. I'm attaching a screenshot of the receipt that they sent me, which does not appear in my online banking records in any format at all.

Just to reiterate - I deposited $2500 in cash into a Wells Fargo account, they posted it to my account, and they pulled it back out. They have altered my banking records to indicate that this transaction did not occur. They are telling me that this is my problem.

I'm here to give you fair warning: WELLS FARGO WILL STEAL CASH FROM YOU AND HAS NO PROBLEM DOING SO. IF YOU ARE A WELLS FARGO CUSTOMER, I STRONGLY RECOMMEND YOU FIND ANOTHER BANK.

Singhjr96

> Wave Motion Gun

Singhjr96

> Wave Motion Gun

02/23/2014 at 19:39 |

|

Bank of america. The way to go. Never had a problem with them. Even when I would take in my piggy bank with rolls of quarters, nickels, dimes, and pennies when I was like 7.

TheBloody, Oppositelock lives on in our shitposts.

> Wave Motion Gun

TheBloody, Oppositelock lives on in our shitposts.

> Wave Motion Gun

02/23/2014 at 19:41 |

|

Report them to the SEC.

Squid

> Wave Motion Gun

Squid

> Wave Motion Gun

02/23/2014 at 19:42 |

|

Get into a credit union. I've been using one since 06, reasonable auto loan rates and generally try not to fuck you over. I like them better than the nationwide chain banks.

MtrRider

> Singhjr96

MtrRider

> Singhjr96

02/23/2014 at 19:45 |

|

Accidentally recommended. BOA is just as bad, if not worse, than WF.

Singhjr96

> MtrRider

Singhjr96

> MtrRider

02/23/2014 at 19:47 |

|

I disagree. I've always used them and have never had a problem. My dad also has like 20+ accounts with them for his business.

TheBloody, Oppositelock lives on in our shitposts.

> Singhjr96

TheBloody, Oppositelock lives on in our shitposts.

> Singhjr96

02/23/2014 at 19:47 |

|

Except that they're probably one of the most evil banks around. Seriously they make robber barons at the turn of the century look like pick pockets.

This is just the tip of the ice burg

http://abcnews.go.com/m/blogEntry?idÖ

MtrRider

> Squid

MtrRider

> Squid

02/23/2014 at 19:47 |

|

For anything less than a mortgage, that's the way to go.

Parth985

> Wave Motion Gun

Parth985

> Wave Motion Gun

02/23/2014 at 19:48 |

|

Fuck you Wells Fargo u guys suck and are a second rate bank .....

MtrRider

> Singhjr96

MtrRider

> Singhjr96

02/23/2014 at 19:49 |

|

Thousands of people can say the same about Wells Fargo. It doesn't mean they aren't a massive piece of shit of an organization.

TheBloody, Oppositelock lives on in our shitposts.

> MtrRider

TheBloody, Oppositelock lives on in our shitposts.

> MtrRider

02/23/2014 at 19:51 |

|

Shit, they both launder money for fucking drug cartels

http://www.theguardian.com/world/2011/aprÖ

Singhjr96

> MtrRider

Singhjr96

> MtrRider

02/23/2014 at 19:53 |

|

OK well i've never had a problem with my bank personally. We get taken care of at that bank. But that's just my experience. Most of the time they aren't trying to screw you over. But let's admit it, almost EVERY corporation out there has done something that can be looked upon as evil.

davedave1111

> Wave Motion Gun

davedave1111

> Wave Motion Gun

02/23/2014 at 19:54 |

|

If you'll take the advice, calm down a bit. It's easy to get emotional about 'being screwed', but that's not what's happening here. It's a business problem, so your reaction has to be a business reaction, and your ways of dealing with it have to be business ways of dealing with it.

It sounds to me like something's got messed-up somewhere, but you have to remember that they're not doing it on purpose. If they've made a mistake, it'll be frustrating, but you should get things sorted out eventually, including compensation if appropriate.

The first thing you want to do is have a really good read of the terms and conditions attached to your account. Then call them, tomorrow morning. Don't be afraid to push your complaint higher up the chain, and give them a first chance to fix things right off - make it clear what the problem is, and see what they will do. Make sure you document the conversation as far as possible, though. If you can record it - with their permission - then that's excellent. If not, write a note immediately afterwards detailing everything you remember of the conversation, then sign and date it. Ideally, have it witnessed by someone as soon as possible, too.

If you can't resolve things that way, then everything else you do should be in writing - either letters or email. As well as approaching it as a customer-service issue, put in a complaint. Don't expect an immediate response, and be prepared to later escalate it directly to the CEO or similar if you don't get a fair response. It's unlikely you'll have to go as far as legal action, or even conceivably getting the police involved.

Wave Motion Gun

> davedave1111

Wave Motion Gun

> davedave1111

02/23/2014 at 19:58 |

|

Thanks for the advice, Dave. I spoke with a supervisor, and she told me that it was my problem, which rubbed me the wrong way entirely. Seeing the transaction record disappear from my online register rubbed me even further. Someone went out of their way after the fact to make that line disappear from the register as a direct result of my conversation, which means they are trying to cover their own asses.

davedave1111

> TheBloody, Oppositelock lives on in our shitposts.

davedave1111

> TheBloody, Oppositelock lives on in our shitposts.

02/23/2014 at 19:59 |

|

You don't want to believe anything you read in the Graun, especially about a) banks or b) drugs. Bit of a conflict for them, really, because they're big legalisation advocates - but they'll rant about 'drug money' when they get to stick it to the Jews, sorry, bankers.

MtrRider

> Parth985

MtrRider

> Parth985

02/23/2014 at 19:59 |

|

And your father smells of elderberries!

TheBloody, Oppositelock lives on in our shitposts.

> Singhjr96

TheBloody, Oppositelock lives on in our shitposts.

> Singhjr96

02/23/2014 at 20:06 |

|

Yeah I don't think most companies help fund cartels responsible for the deaths of over 70000 people in Mexico... There is "evil" and then there's aiding and abetting genocide.

TheBloody, Oppositelock lives on in our shitposts.

> davedave1111

TheBloody, Oppositelock lives on in our shitposts.

> davedave1111

02/23/2014 at 20:08 |

|

Except the FBI is investigating BOA/WF and a few others for laundering Cartel money.

Singhjr96

> TheBloody, Oppositelock lives on in our shitposts.

Singhjr96

> TheBloody, Oppositelock lives on in our shitposts.

02/23/2014 at 20:09 |

|

Ok.... I'm not going to try anymore. But couldn't that be just because of one specific bank? Maybe somebody was payed off or something?

-edit- apparently they used smurfs(name for a large group of people like maid, etc) to transfer the sum in multitudes of transactions less than 500 which was then transferred to a multinational bank.

Squid

> Wave Motion Gun

Squid

> Wave Motion Gun

02/23/2014 at 20:09 |

|

Walk into the branch Monday, close your account down and take funds to your local credit union and not deal with Wells Fargo. The act of closing your account will basically force their hand in the matter and cause them to either change their mind on this matter. Don't let them say that the funds are unavailable to you when you close the account down either.

DarrenMR

> Wave Motion Gun

DarrenMR

> Wave Motion Gun

02/23/2014 at 20:16 |

|

Keeping a clear head is going to be important in this. This isnt anything at all like I do in my field, but I am definitely more willing to help people who are nice and friendly then people who are asshats. Screaming and cursing only frustrates the person thats assisting you and sometimes they can make stuff worse for you.

davedave1111

> Wave Motion Gun

davedave1111

> Wave Motion Gun

02/23/2014 at 20:17 |

|

Maybe someone did, in which case it's almost certain someone higher up in the bank will be just as unhappy about it as you - banks are very, very, very big on accountability, for obvious reasons. It's possible but unlikely that there's a criminal or rogue employee involved.

It's more likely to be a combination of misunderstood T&C's and bad customer service, I'd have thought.

It's just a guess, but possibly what happened is that the bank made an initial error in letting you take any of the cheque as cash, or something changed after they gav it to you, like you triggered some fraud or money laundering protocol or some such. They then had to roll back the transaction where they gave you $2500. Depending on what the T&C's said, it may be that you'd assumed the risk of the rollback happening and they needed to get $2500 back from you. They could either charge you an overdraft fee, or take the money from your account if it was there, so they took it from your account - maybe even because your local banking regs said they had to, for all I know about the details.

It sounds like as a bare minimum there's been unacceptably bad communication on their part, including with the online banking changing. Maybe also an administrative error as well. Mistakes happen even with good intentions, so your best bet is to see what they'll do to put them right.

By the way, for what it's worth in a completely different country - the UK - my bank will let me draw against a cheque as soon as I deposit it, but until it clears I take the risk that it won't be paid. If it bounces, I'd have to deposit funds to cover the withdrawals (if necessary). It's been years since I had that problem, but then I've never received a cheque for £50k+. Definitely a first-world problem you're having :)

davedave1111

> TheBloody, Oppositelock lives on in our shitposts.

davedave1111

> TheBloody, Oppositelock lives on in our shitposts.

02/23/2014 at 20:24 |

|

Sorry, I thought there was an implicit 'without independent corroboration'. FBI investigations are not the same as convictions.

Slave2anMG

> Wave Motion Gun

Slave2anMG

> Wave Motion Gun

02/23/2014 at 20:29 |

|

And if you get no joy, call your local TV station troubleshooter/on your side/whatever. That kind of bad PR works wonders.

The Dummy Gummy

> Wave Motion Gun

The Dummy Gummy

> Wave Motion Gun

02/23/2014 at 20:30 |

|

It kind of sounds like you will get the money back when the $86k clears. I would recommend leaving the big banks and joining a credit union. You'll earn around 1% on your checking account and they are much friendlier.

If you need any recommendations please let me know.

Wave Motion Gun

> The Dummy Gummy

Wave Motion Gun

> The Dummy Gummy

02/23/2014 at 20:39 |

|

I will, but the point here is that I committed the cash they gave me to other obligations, which may end up not clearing. If they had not given me the cash, I could have used other funds and not been placed in a situation where money I promised someone else is not going to be delivered due to someone being deceptive with me.

DeltawingGothamDeserves

> Squid

DeltawingGothamDeserves

> Squid

02/23/2014 at 20:49 |

|

My local one gives out damn good interest too.

TheKingOfBirds

> davedave1111

TheKingOfBirds

> davedave1111

02/23/2014 at 21:04 |

|

I see an issue of exposure, the bank would rather pay a couple hundred bucks in overdraft fees than be out the bigger sum of $2500. Scams are so ubiquitous these days. At any rate, the cool head advice is spot on. Talk to them, explain that their initial mistake (of letting you have the 2500) is going to cost them some money. As long as they agree to cover any extra fees then the bank is the only party that will be out extra money. I forgot to endorse a check once, then the bank decided they needed to hold it for a ridiculous amount of time which put me in the same boat you are in. They just told me to save all the receipts for overdraft fees and cut me a check on the spot when I brought them in.

desertdog5051

> Wave Motion Gun

desertdog5051

> Wave Motion Gun

02/23/2014 at 21:12 |

|

B of A, W F, they are basically crooks and are too big to help you and the employees know nothing and thus employees tell you what they think is correct. Join a local Credit Union. The one I belong to still has real people who answer the phone and can help you.

PRBot II

> Wave Motion Gun

PRBot II

> Wave Motion Gun

02/23/2014 at 21:13 |

|

I use Bank Of America, and I've been noticing armed guards at the doors every now and then. I took this picture last week. If there were Brinks trucks around, I wouldn't think twice about it. But at a couple different locations over the last year or two, they've been stationing guards just for general security. It seems like they are worried for the safety of their employees across multiple branches.

Ever since the bailouts, it seems like news articles covering shady bank practices have been popping up with increasing frequency. I remember back in the 90's when keeping money in a savings account came with a little interest paid in. Now my account gets charged a "monthly maintenance fee". I interpret that to mean "we want your money, so we're just gonna take it".

This was the closest shot I could get of him, as I was leaving. I prefer not to piss of guys with loaded pistols. He saw me take the picture and was grilling me until I left the lot. It was worth it.

midnightautoparts

> Wave Motion Gun

midnightautoparts

> Wave Motion Gun

02/23/2014 at 21:13 |

|

Don't be offended if I poke my nose where it doesn't belong, but from without a lot of details I have a feeling that you are being scammed, and not by your bank. Was this check a "lottery" winning check? Is the sender requiring $2,500 payment to be sent Western Union or MoneyGram? If so, be aware that the check you received was fraudulent and will bounce in about 2 weeks. BE CAREFUL!

Nimrodical

> Wave Motion Gun

Nimrodical

> Wave Motion Gun

02/23/2014 at 21:17 |

|

Wells Fargos holds are ridicules. I now deposit my larger checks into my credit union who normally has a 1 day hold. I then get a free cashiers check made out to myself for a smaller amount which I then deposit in my wells checking account.

With electronic banking and the speed of verification and fund transfers Wells Fargo is basically holding your money hostage and using it for their own gains. There is no sane reason for a 7 day hold other then they are using YOUR money and paying you nothing for it. Thieves! If I didn't travel abroad so much and enjoy using ATMs (for a fee) all over the world I would completely switch everything to a credit union.

Nimrodical

> Squid

Nimrodical

> Squid

02/23/2014 at 21:20 |

|

Wells Fargos holds are ridiculous. I now deposit my larger checks into my credit union who normally has a 1 day hold. I then get a free cashiers check made out to myself for a smaller amount which I then deposit in my wells checking account.

With electronic banking and the speed of verification and fund transfers Wells Fargo is basically holding your money hostage and using it for their own gains. There is no sane reason for a 7 day hold other then they are using YOUR money and paying you nothing for it. Thieves! If I didn't travel abroad so much and enjoy using ATMs (for a fee) all over the world I would completely switch everything to a credit union.

Wave Motion Gun

> midnightautoparts

Wave Motion Gun

> midnightautoparts

02/23/2014 at 21:57 |

|

That's a completely fair question. This was a legitimate transaction, and the check was from another financial institution. Essentially, this was a consolidation of accounts that are mine.

midnightautoparts

> Wave Motion Gun

midnightautoparts

> Wave Motion Gun

02/23/2014 at 21:59 |

|

Cool, I didn't want to see you getting taken! Best of luck.

JasonStern911

> Wave Motion Gun

JasonStern911

> Wave Motion Gun

02/23/2014 at 22:13 |

|

My parents used to have Wells Fargo. Then one day, they somehow lost one of dad's paychecks, causing financial strain as my dad had to get a stop payment placed on the check and a replacement check issued, which took a while. My mom immediately switched the whole family to US Bank, which I still have an account with. Although, honestly, local credit unions tend to be my favorite banking establishments.

wkiernan

> Singhjr96

wkiernan

> Singhjr96

02/23/2014 at 22:14 |

|

I certainly did. I used to deposit cash, U.S. Federal reserve notes, in my wife's BOA checking account on Monday afternoon, and she'd write a paper check to the grocery store on Thursday afternoon, and the check would bounce, with a fee from the grocery store on top the the $35 overdraft charge BOA would hit us with.

wkiernan

> DeltawingGothamDeserves

wkiernan

> DeltawingGothamDeserves

02/23/2014 at 22:16 |

|

Not to mention I've gotten two car loans from my credit union quicker and with less hassle than buying a hoagie at a deli. Credit unions YAY!

Wave Motion Gun

> Squid

Wave Motion Gun

> Squid

02/23/2014 at 22:20 |

|

Best banking experience I've ever had was 10 years with a credit union. They voted themselves into becoming a bank, and completely went to hell. I moved to WF after that, and will definitely be going to another CU after this.

Singhjr96

> wkiernan

Singhjr96

> wkiernan

02/23/2014 at 22:22 |

|

I'm done. Bye-bye y'all. I'm going to do something. Idk what, but something.

Yowen - not necessarily not spaghetti and meatballs

> Squid

Yowen - not necessarily not spaghetti and meatballs

> Squid

02/24/2014 at 09:53 |

|

3% interest on my checking, I can use any ATM I want (they refund at the end of the month) and decent loan rates. Credit union = no brainer.

Korea Miťville

> MtrRider

Korea Miťville

> MtrRider

02/24/2014 at 11:18 |

|

Wells Fargo turned me into a newt!

(I got better.)

4play

> Wave Motion Gun

4play

> Wave Motion Gun

02/25/2014 at 16:53 |

|

What kind of check did you deposit? Banks can generally hold funds if they believe that there is a likelihood that the check is not good. This can be done manually, but is usually done by computer algorithms. SO if you don't usually deposit almost 6-figure checks, they have the right to legally hold your money until the 7th business day. Also, the bank does not have to legally release to you more the $200 on the same business day as your check is cashed (if before the cutoff).

It's likely that your check was flagged immediately after the deposit (after the teller had already given you the $2500). Wells Fargo's computer systems realized this, so when you deposited the $2500, it was associated with the check and therefore placed under the 7 day hold.

TL;DR the teller screwed up by giving you the money, check was held, you got screwed.

The real issue is the failure of Wells Fargo's customer service to explain all of this to you in a polite and professional manner. Take your business elsewhere or at the very least, complain to the corporate hotline and demand that your account be upgraded to the highest level (if it's not already). Also argue for zero fess on anything you may get surcharged on as well.

Wave Motion Gun

> 4play

Wave Motion Gun

> 4play

02/25/2014 at 22:25 |

|

It was a check, with supporting documentation, from another major financial institution. It could have been verified by one phone call.

Today WF decided to double down on me. I woke up this morning to find that the first hold of $4800 had been released on the account. It was shown as posted and available. At about 5:00 this afternoon, I received notification that 3 payments totaling less than the original $2500 cash deposit were declined, with a 37.50 fee for each. So not only did they take the original cash deposit from me, they used creative accounting to decline payments I made, causing me to be late, and charge me for it.

After 2 hours on the phone with them, I was offered a refund on one of the three fees, and 50 percent of the others. I declined, stating that acceptance would indicate that I felt this was a fair resolution. Amazingly enough, the rep agreed with me. He seemed astounded that this was happening, and that, as a Wells Fargo customer, he was concerned that this could happen. He told me to go to the local branch in the morning and meet with the manager, who has the authority to deal with this kind of issue.

My plan now is get resolution through the branch to the best of my ability, wait until the check clears, withdraw all of my money in cash, then move it to my Navy Federal Credit Union account, where it should have been in the first place. After that, Wells Fargo will never see a cent from me as long as I live.

4play

> Wave Motion Gun

4play

> Wave Motion Gun

02/26/2014 at 10:43 |

|

"It was a check, with supporting documentation, from another major financial institution. It could have been verified by one phone call."

Unfortunately, that's not how the check clearing process works. These days, it's almost entirely a computerized process once the check is deposited and there's really not much an individual banker/employee can do.

brianbrannon

> Wave Motion Gun

brianbrannon

> Wave Motion Gun

02/28/2014 at 20:33 |

|

I don't know why everyone doesn't take their money out of the banks and use their local credit unions

Wave Motion Gun

> brianbrannon

Wave Motion Gun

> brianbrannon

02/28/2014 at 20:46 |

|

Neither do I. Considering I have a Navy Federal Credit Union account, I consider myself an idiot.

To wrap things up, Wells ate all of the NSF fees, posted all payments on time, and was apologetic in the end. The local branch manager actually used the phrase "We fucked up" before it was done.

Kongfish

> Wave Motion Gun

Kongfish

> Wave Motion Gun

12/05/2014 at 15:37 |

|

you can get this fixed and have them put every penny back I to your account. Now before I tell who to call did you fill out a deposit slip for the $80,000 minus- the $2500 if you do then there is your proof, first go to a different branch and talk to that branch manager ( don't act like an ass, be nice polite, & friendly) practice what your going to say at home before you go, remember being an ass will probably be a waste of your time. If the manager at a different branch can't help you, get the phone number to the federal reserve consumer complaint investigation dept. this is the last thing in the world a bank wants. The FEd is like in the banks place and the bank will be in your place. What they say goes. Once they do an forensic accounting of your transactions and discover that they screwed you, the money will be placed back into your account at once, and the the bank will have a BIG Black Mark placed on their account, similar to what would happen to you if you had a bill to pay and never paid that bill. Your credit takes a wack which hurts your chances to get credit until it is paid them the mark is still there. Now since Obama is in bed with the bankers,( 28) of Goldman Sachs employees where appointed whitehouse staffer jobs upon him winning the election. Any way he has done a lot of law rewriting in the cover of darkness the media will never report on. So, I can't say for sure that the consumer complaint dept is even open, he may have changed the law that's been in effect since after the 1929 depression and that department may now be a dept that is there to attack the little man and protect the banks.

Landon

> Wave Motion Gun

Landon

> Wave Motion Gun

10/24/2015 at 08:57 |

|

By law, after you deposit a large check and its placed on extended hold, $200 will be available to you the next day (on Saturday in this case) and another $4800 on Tuesday. If you had your bills scheduled to come out on Monday, you should have not incurred any OD fees since on Tuesday morning, while yes, your account was overdrawn, you should have had a total of $5000 available. There could have been a lot of reasons why the hold was placed - most commonly the maker of the check had funds pending in their account and wf needed to make sure the $ gets collected and you donít spend any more money of that check just in case the check wonít pay. The person who decided to give you $2500 cashback didnít have intentions to screw you, but itís not up to that person whether the hold gets placed or not. It takes an hour before the check goes thru the check system and then, like I said, if thereís something wrong on the other end (maker doesnít have enough funds, deposits are pending, itís a new account, had recent overdrafts or returned checks) the hold will be placed to avoid losses.

Ash78, voting early and often

> Wave Motion Gun

Ash78, voting early and often

> Wave Motion Gun

04/20/2016 at 09:33 |

|

Just substitute ďWells FargoĒ with any other national bank and youíll get the same thing. Funds availability timing is a PITA everywhere, but with local or regional people, youíre much more likely to get a swift and reasonable resolution in exchange for their knowing you personally. There are often other mechanisms in place that can go behind a branch managerís back and cause these hassles, even contradicting what the branch manager said in person. But no matter where you go, any deposit of $10k+ is going to potentially be subject to longer holds and the bank has to fill out extra paperwork for it. So I wonít defend WF in this case, just pointing out that this probably all came from questionable training and poor communication between the branch and corporate.

Tseve

> 4play

Tseve

> 4play

05/10/2016 at 18:04 |

|

My dad is missing $45 from his Wells Fargo checking account. My dad monitors his money very thoroughly. My dadís story is very similar to this person who wrote the article. My dad gets direct deposit from his job. He knew how much he had left after paying bills. He is missing $45 from his account and apparently Wells Fargo is not showing any historic record of where that money went. Personally I am sick and tired of banks & governments. I donít care if they offer interest, because the interest is usually not that much nowadays... Especially for someone who doesnít make 6 figures yearly. Just like in the United States year of 1929 when the economy crashed, banks took away a lot of peopleís money. I also learned that grease took a lot of peopleís money and purposely gave them a limited amount of time to pull their money out. Grease played a dirty game with their customers/citizens. A banking customer was only able to pull out a limited amount of money daily from their Bank. And they only had a limited amount of time/days to get all their money out. So when the banks in Greece finally closed down many people lost tons of money. Except for the banks and the government of course. It sounds to me like our governments and our banks are planning on screwing us over. They are not trustworthy anymore and donít deserve our money. They are trying to force a cashless Society ( credit cards , direct deposit, possibly future mark of the beast Etc) on to us so that way they can control our financial lives. We the people should invest our money in valuables like gold, silver, canned goods, guns, etc because if the governments ever fall we will need a way to barter and trade and make money.

Tseve

> 4play

Tseve

> 4play

05/10/2016 at 18:26 |

|

Thereís not much individual Banker/employee can do? Everything is computerized? Here is the deal... I am getting sick and tired of every single human being relying on pathetic technology. If everyone relies on nothing but technology then why are they working and why are they getting paid for machines to do the work for them?

(This is why Public Schools Offer us horrible education they donít want to teach us the old-fashioned way and they donít even want to teach us how to truly understand tech. Instead they want to dumb everybody down and make it where only the small few who understand technology can control our very existence with it.)

We (humans) made these machines... so humans should have the free reign to control each and every machine ( meaning that a manager in a company should have complete knowledge to take over the system when necessary in order to correct any mistakes and return to the customer what is owed to the customer.) End of story. Donít talk to me about trust because obviously banks already are not trustworthy. But the people working for the banks must not be very smart if they cannot help customers with their money problems (when they should be able to) & make sure any customer gets all their money. But because this happens too often I donít think itís a mistake anymore... I think itís the banks conspiring against the customers.

If a company is not going to take action to help their customers then they donít deserve anything. what they deserve is a lawsuit and to be shut down permanently. Finally they deserve to have one of the worst reputations for horrible customer service in all of existence. So that way the people who made the company have a harder time ever starting up another company. Whether it be a bank, a construction business or even a government Institution. Finally I realize how often Banks win the lawsuits placed against them by customers who felt that they were screwed over by the Banks they did business with. Banks can never say they donít understand whatís going on because banks are filled with accountants so they know very well what the laws are and how to get around them. Banks know how to screw us over. So at the end of the day we should all invest our money into valuables and lock those valuables away out of sight from Banks , governments and kingdoms. Because if thereís ever a day when we need to survive without them we can barter and trade with what we have. Thatís why I believe in the 2nd Amendment because this government would love nothing more then to make us defenseless when itís time for them to murder us for our resources and valuables. They really donít care about the lives lost because of guns they know that the truth is is that itís not the gun that kills people but the human being who has a mental problem that kills people. But they go along with taking our defenses away for their own agenda. Donít believe me ? Do a lot of research like I have.

Pizzaisgoodforthesoul

> Tseve

Pizzaisgoodforthesoul

> Tseve

08/02/2016 at 00:03 |

|

So now youíre bringing guns into this? My god, do you know how bat shit crazy you sound? You started off your rant, respectively, arguing against the need for automated systems (which is what are used to clear checks, to make sure that the check is good and that the person writing the check has funds in the debiting account) itís not the bankers fault you spent the money in the account and the check didnít clear. They canít tell if a check is fraudulent (especially if itís a very convincing one which scammers are getting pretty good at). It takes 14 days for checks to clear. Computer aided systems make work a lot easier and efficient. If we took technology out of the equation and relied solely on manual work (as far as banking goes), you wouldnít be able to use a debit card, credit card, banks would collapse because funds wouldnít be kept electronically and to top it off, you would be stuck carrying around cash which sucks if you get robbed because you canít just deactivate your money like you can a card.

In all seriousness, your argument just sounds like a lot of nonsensical ranting about your own personal agenda with your stance on education and gun ownership.

BurnyFalls

> Wave Motion Gun

BurnyFalls

> Wave Motion Gun

09/29/2016 at 23:26 |

|

I had $300 mysteriously disappear from my wells fargo savings account when I first moved to California. I double checked every statement and wasnít making errors. Couldnít get any one to help me, really wish Iíd have filed a complaint somewhere! Now I know that they did steal from me!

noloveinfear

> Wave Motion Gun

noloveinfear

> Wave Motion Gun

10/01/2016 at 01:15 |

|

Reading this 2 years after the fact - with the recent news regarding the EXTREMELY SHADY accounting at Wells Fargo - is there any indication your experience was related to that?

Blair23

> Wave Motion Gun

Blair23

> Wave Motion Gun

11/17/2016 at 11:47 |

|

4play is completely correct. When you get cash back from a check, and then turn around and deposit the cash, that can be a redflag per the Patriot Act and Reg CC.

Did you gave 2500 in your acct to cover the 2500 less cash? If not, that would explain why you had issue.

86k check is a LOT of money, especially when it is out of the usual behavior or deposits. The bank needs to protect itself from losses, while abiding by reg†CC set forth by the government.

And sadly, they canít call to verify the check unless otherwise expressly written on the check. (Like spring leaf financial in which the teller MUST make the call). But if it was a personal check or even a Cashiers check (frequently frauded), they canít call the institution and ask for the balance from which the check was drawn. There are massive privacy laws there. If it was WF To WF then they could have checked the acct and verified all details.

Could the situation have been handled differently? Absolutely. But they did follow reg CC procedure. And even if you have been a customer there for several years with a mortgage as well, does not mean that makes you less likely to unknowingly deposit a bad check.

National banks are held to a different governing entity than local banks. (Local band are subject to the FDIC and national banks are governed by FDIC AND OCC. This means national banks have more regulations to follow and can be more difficult, through no fault of their own). Fulton Bank, upon its expansion into several states, got a cease and desist order from the OCC because they were not abiding by its regualtions. However, it was fine with the FDIC. The 2 frequently contradict each other.

I completely understand your frustration. And it could have been handled better, I suspect the teller did not do EXACTLY as they should have, or rolled the dice a little, which is NOT okay. (For both you and the bank).

I worked as a teller manager for several banking institutions. I do not miss working in the industry.

Elizabeth

> Wave Motion Gun

Elizabeth

> Wave Motion Gun

09/13/2017 at 12:09 |

|

Wow! This happened to me as well. I deposited 1700 cash for my rent and that check bounced. I logged into account and was short 900. Had all my deposit slips that showed full deposit. Some how they managed to wiggle their way out of any wrong doing. I canít believe banks are not held accountable for their mistakes or maybe not a mistake. I never got that 900 back. I think the embarrassment of t the bounced check was worse.

BewareOfWellsFargo01

> Wave Motion Gun

BewareOfWellsFargo01

> Wave Motion Gun

09/11/2018 at 19:46 |

|

Today Wells Fargo essentially did the same to me. I deposited money from Cash app into the account yesterday. The funds were available and transactions were posted to my account. I made a few small purchases for food and gas. As of today, my account was overdrafted and all transactions and records of this deposit are removed from the entire system. They escalated it all the way to the executives office and was told thereís no record of this transaction. Yet out of the 8 people I spoke to today, two of them told me they see that the transaction occurred and then reversed back to Cash app. There is no record of this with Cash app. Essentially, the money was deposited and the transactions all erased (except for the purchases I made and the overdraft fee theyíre now charging me.) If I was rich, and this were much more money than it is, I would sue the shit out of Wells Fargo and go to the newspapers with my story. However Iím a recent poor college grad and I now just simply have no money for ramen noodles this week. Iím telling everyone I know about my experience with Wells Fargo. This bank is conducting unethical, illegal, and simply evil business. Do not by any means use this bank a day in your life. PNC is a decent option. Iím heartbroken and hungry. I hate you Wells Fargo.

Wave Motion Gun

> BewareOfWellsFargo01

Wave Motion Gun

> BewareOfWellsFargo01

09/11/2018 at 20:09 |

|

Iíve moved on to Navy Federal and couldnít be happier. †Fuck Wells Fargo.†

Robin G

> BewareOfWellsFargo01

Robin G

> BewareOfWellsFargo01

12/13/2018 at 19:21 |

|

I had a 58 month CD and when I went to Wells Fargo to transfer the money into another account it was short $15,000. The CD is well over the 58 months but they insisted that I withdrew the money or the very same day that I opened a smaller CD. That is just a lie. I have never touched either account. Thieves.